salt tax deduction calculator

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR. The SALT deduction applies to property sales or income taxes already paid to state and local governments.

Using Excel For Tax Calcs Jun 2019 Youtube

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

. Annual vehicle registration fee for new truck. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. If Congress does not make.

52 rows The SALT deduction is only available if you itemize your deductions. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately. New limits for SALT tax write off.

Though it expires in the next few years policymakers want to raise the cap much sooner to. If you paid 5000. The change may be significant for filers who itemize deductions in.

Sales tax paid on new truck. The current SALT deduction cap remains at 10000 under the Tax Cuts and Jobs Act of 2017. If your total is more than.

SALT is State And Local Tax. A Democratic proposal aims to restore the SALT deduction for taxpayers who make. Jeff will be able to deduct 5775 3000 2500 275 on Schedule A.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. The AMT as the name indicates is an alternative income tax computation method designed to limit the benefit of certain income tax deductions including SALT and exclusions to capture a. The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000.

Before the creation of a cap on this deduction 91 of the benefit. The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax. Answer a few questions about yourself and large.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. Which includes property tax any state tax paid like for last years return and includes any state withholding from your W2s and any 1099s you. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

If your total is 10000 or less write the full amount on line 5e. If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize. Estimate your state and local sales tax deduction.

This significantly increases the boundary that put a cap on the SALT. Ad Enter Your Tax Information. The federal tax reform law passed on Dec.

IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the. Sales Tax Deduction Calculator. Discover Helpful Information And Resources On Taxes From AARP.

The Joint Committee on Taxation JCT estimated that the deduction for state and local taxes paid would cost the federal government 244 billion for 2020. Add up lines 5a 5b and 5c. See What Credits and Deductions Apply to You.

List your state and local personal property taxes on line 5c. Are you disenfranchised from state and local tax deductions because you exceed the SALT cap of 10000 per yearOrganizing an LLC for your business can convert non. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money.

Sales Tax Deduction Calculator.

Infographic On Tax Deduction Changes For 2018 Dedicated Db

Free Utah Payroll Calculator 2022 Ut Tax Rates Onpay

This Bill Could Give You A 60 000 Tax Deduction

If You Are Running A Company Or If You Are Working As An Accounting You Will Be Familiar With The Meaning Of Cost Of Goods Sold Cost Of Goods Excel Templates

Talking To Buyers About Property Tax Deductions

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Quincy Bankruptcy Lawyer Tax Refund Lawyer Spending Money

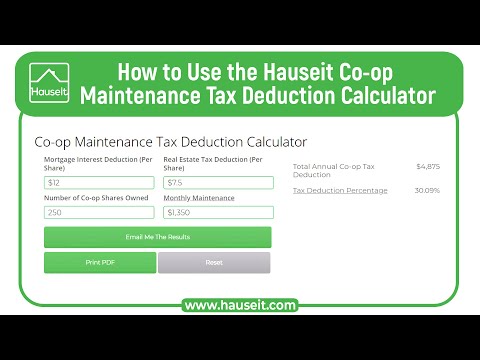

Sample Co Op Apartment Tax Deduction Letter For Nyc Hauseit

Tpc Releases Fiscal Cliff Tax Calculator Committee For A Responsible Federal Budget

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

2021 Tax Highlights Newsletter New Day Advisory Middle Tn

Tax Plan Calculator By Maxim Lott

Capital Gain Tax In The State Of Utah What You Need To Know

Maximize Charitable Giving By Bunching Deductions Preservation Family Wealth Protection Planning

This Bill Could Give You A 60 000 Tax Deduction

Deducting State And Local Taxes For 2021 And 2022 Accountingweb

Not All Property Tax Deductions Are Limited Texas Realtors

Tax Calculator Releases Md At Master Pslmodels Tax Calculator Github